As more tourists flock to Dubai, short-stay rental units are gaining more popularity, with experts estimating over 30,000 offerings in the city. So if you’re wondering how to start an Airbnb business, now is the best time to learn how to do it.

Benefits of a Dubai Airbnb Business License

High Tourism Rate

Dubai had over 7 million tourists in the first quarter of 2025, an increase from 2024. The city’s growing tourism population serves as a lucrative market for anyone looking to enter the Airbnb market.

Favourable Tax Environment

Simpler Business Setup Process

Documents for Dubai Short-Term Rental License

1. Choose a Location

2. Select Company Structure & Trade Name

Structures like sole establishments and LLCs are common options for Airbnb businesses. Airbnb owners also have to register a unique trade name for their business. A business setup consultancy in Dubai can help you choose a legal structure that supports your business needs.

3. Apply for a License

The Department of Economy and Tourism (DET) is the regulatory body that will grant your Airbnb business license. You will need a license to start your Airbnb business and a separate permit to validate your intended property listing as a “Holiday Home”.

Initial approval from the authorities will be required before you apply for a vacation home license in Dubai. The license can be issued for one year, up to four years.

Documents for Dubai Short-Term Rental License

- Initial approval application

- Owner’s personal identification documents (Passport, Emirates ID)

- Certificate of Good Conduct

- No Objection Certificate (NOC) from landlord (if necessary)

- Ejari (if necessary)

- Title deed

- DEWA bill (for the last 3 months)

- Property management letter

4. Open a Bank Account

After you get your business license, you need a bank account for your company. The business setup consultants at A&A Associate can help you open a bank account by using their existing relationships with local banks in Dubai.

5. Start Your Airbnb Business in Dubai

Once you get approval from the DET and have your license and permit ready, you will need to prepare your unit for listing. This involves:

- Conducting fire and safety checks

- Getting the unit professionally cleaned

- Investing in decor and interior design

- Stocking up on amenities

- Take photos and videos of the property for the online listing

- Write a description of the unit for the listing

What are the Airbnb Legal Requirements in Dubai?

- You need a valid license from the Department of Economy and Tourism to run your business.

- Every owner must stay compliant with the country’s tax obligations.

- Every Airbnb business owner must collect the “Tourism Dirham fee” from their guests and remit it to the DET by the 15th of every month.

- Every rental unit must be registered with the DET.

- You must have the necessary insurance policy to operate your business.

- Failure to comply with the business regulations can result in fines up to AED 20,000.

- If you own multiple homes, you can only list up to eight homes.

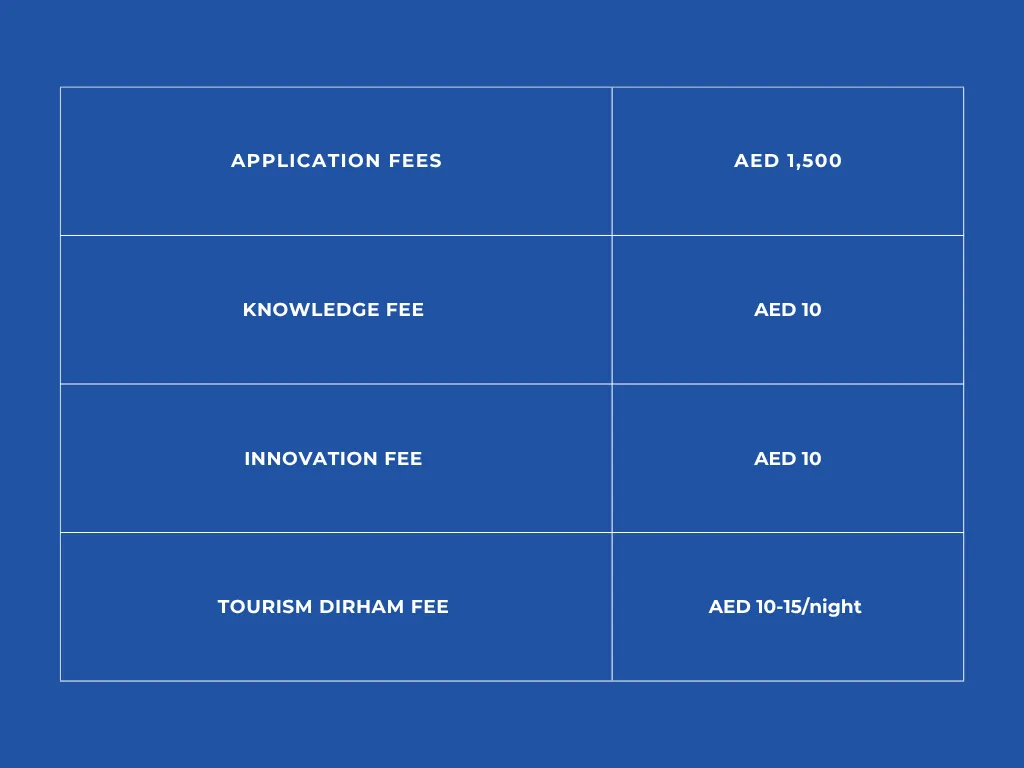

Cost of Starting an Airbnb Business

Get an Airbnb Dubai License With A&A Associate

A&A Associate offers expert services in company formation in Dubai for entrepreneurs all over the UAE. We offer competitive company formation packages that are tailored to your business needs. Book a free consultation with us today!