An audit report is one of the most important financial documents a business can receive.

Investors, banks, regulators, and other stakeholders use it to determine the trustworthiness of a company’s financial statements.

This guide explains what an audit report is, the different types of audit report, how to read an audit report, and the risks associated with each audit opinion.If you’re a local business, working with an audit firm in Dubai can help you

What is an Audit Report?

An audit report is a formal written opinion issued by an independent auditor after examining a company’s financial statements. The purpose of the audit report is to state whether the financial statements present a true and fair view in accordance with applicable accounting standards.

Audit reports are commonly used for:

- Regulatory compliance

- Bank financing and credit facilities

- Investor due diligence

- Shareholder reporting

If you’re a local business, hiring expert audit services in Dubai can help you stay compliant with the UAE’s audit regulations.

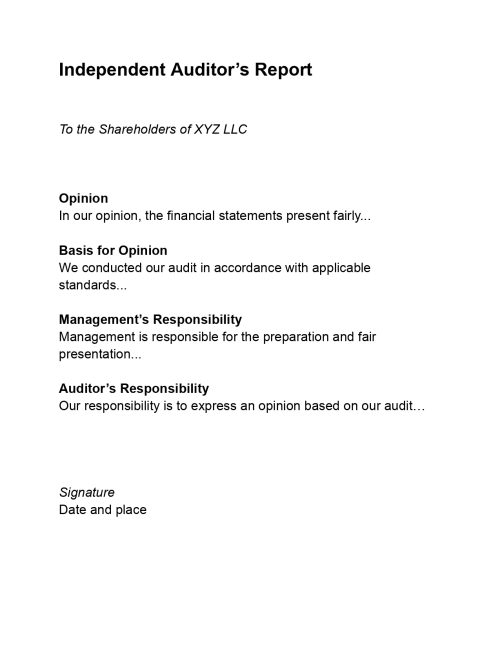

What Does an Audit Report Contain?

While layouts may differ slightly, a standard audit report usually includes:

- Title and addressee

- Auditor’s opinion

- Basis for opinion

- Management’s responsibility

- Auditor’s responsibility

- Signature, date, and place

Among these, the audit opinion determines the type of audit report you receive.

Types of Audit Reports Explained

There are four main types of audit report, each reflecting a different audit outcome.

1. Unqualified Audit Report (Clean Opinion)

An unqualified audit report means the auditor found no material misstatements in the financial statements. This is the most favorable audit outcome.

What it indicates:

- Proper accounting standards were followed

- Financial records are complete and accurate

- Internal controls are functioning effectively

As an audit report example, this is what an unqualified opinion sounds like:

“In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the company in accordance with applicable accounting standards.”

2. Qualified Audit Report

A qualified audit report is issued when the auditor agrees with most of the financial statements but identifies specific issues. These issues are material but not pervasive.

Common reasons include:

- Insufficient documentation for certain balances

- Limited audit scope in one area

- Non-compliance with accounting standards for a specific item

3. Adverse Audit Report

An adverse audit report means the financial statements contain material and widespread misstatements. This is a serious, negative audit outcome.

What it implies:

- Financial information is misleading

- Accounting standards were not followed

- Stakeholders cannot rely on the statements

4. Disclaimer of Opinion Audit Report

A disclaimer of opinion is issued when the auditor cannot obtain sufficient audit evidence to form an opinion. It does not confirm misstatements but signals uncertainty.

Typical causes:

- Missing or incomplete records

- Severe restrictions placed on the auditor

- Inability to verify key balances

Comparison of Audit Report Types and Business Risks

Not all audit reports carry the same level of risk. Understanding these differences helps businesses anticipate regulatory response and financial consequences.

Risk Analysis by Audit Report Type

- Unqualified audit report: This carries the lowest risk. Financial statements are considered reliable, and approvals usually proceed without delay.

- Qualified audit report: This presents moderate risk. Banks and regulators may request explanations or corrective actions before approvals.

- Adverse audit report: This carries high risk. Financing is often denied, and regulatory scrutiny increases significantly.

- Disclaimer of opinion: This carries very high risk. Approvals are commonly delayed, and re-audits are often required.

Audit Report Type | Risk Level | Likely Outcome |

Unqualified audit report | Low | Normal approvals and acceptance |

Qualified audit report | Medium | Conditional approvals and follow-ups |

Adverse audit report | High | Funding rejection and penalties |

Disclaimer of opinion | Very high | Delays, re-audits, regulatory review |

Audit Report Format Example

Below is a simplified audit report sample format for reference:

This structure is consistent across most professional audit reports.

Why Audit Reports Matter for Businesses

An audit report directly influences:

- Loan approvals and renewals

- Investor confidence

- Regulatory compliance

- Business valuation

- Corporate credibility

Even a qualified audit report can delay your important decisions if you don’t address it immediately.

How Often Should Businesses in the UAE Conduct Audits?

Most free zone companies are required to conduct an annual audit as part of their license renewal. Mainland companies do not have a set audit timeline, but are recommended to conduct one every year to maintain compliance standards.

If you have a Dubai business setup, your jurisdiction and business activity will determine your audit requirements.

Understanding the types of audit report, reviewing an audit report example, and knowing the risks associated with each opinion helps businesses make informed decisions. A&A Associate provides expert auditing support for businesses across the UAE.