Ras Al Khaimah International Corporate Centre

RAK Offshore

Home / Offshore Company Formation in Ras Al Khaimah – RAKICC

Ras Al Khaimah International Corporate Centre

(RAK ICC)

RAK ICC Free Zone or Ras Al Khaimah International Corporate Centre has come up with several unique regulations to incorporate international companies. RAK ICC works similar to the concept of offshore company. The regulations describe that incorporation of international companies shall process through a registered agent. Usually, the firms of accountants and lawyers are licensed and permitted to provide services to clients for registering international companies or international company formation, their registered office and act as the agents for the companies. An experienced business setup consultant can assist you with RAK Offshore company formation.

Salient features of the International Company include:

- Company formation UAE will have a limited liability status and the possible name suffixes are ‘Limited’ or ‘Incorporated’

- Companies are formed with a minimum of one shareholder and there is no restriction in the number of shareholders.

- International company formation will require a minimum of one director and there is no restriction in one person assuming these offices or exercising the said capacities

- Corporate director and shareholder allowed

- Company formation UAE requires no minimum capital.

- Shares can be of different classes

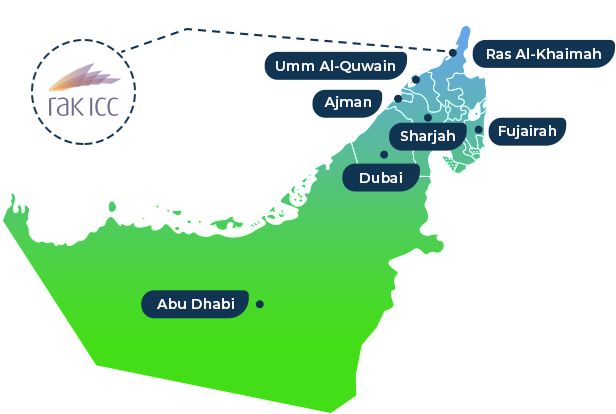

Offshore Locations

- Shareholders and directors are not required to be personally present before the authorities for incorporating the company but will need to be present before the registered agents to sign the relevant documents

- Provision for the shareholders/members to apply the applicable law of their choice

- Requirement to have an approved registered agent either within the Free Zone or outside the Free Zone but within UAE

- International trade is allowed

- Business company regulations have the provision to reserve the company name during the pre-incorporation period, subject to a maximum of 90 days and by paying the prescribed fee

- No personal or corporate income tax

- Foreign names and characters may be included in the company’s name subject to the approval from the authority

- It is not mandatory to submit the accounts audited on an annual basis. However, it should be maintained annually.

- The international company formation will not be entitled to any residence visas in the UAE

International company formation allows you to:

- Have contacts with legal consultants, lawyers, accountants and auditors in UAE

- Have a bank account in UAE

- Become a shareholder in a new or existing company in UAE

- Keep up the shareholder and director meeting within UAE.

International companies are not allowed to:

- Have business with persons in the Zone

- Have a banking business

- Have an insurance or re-insurance company, insurance brokers or insurance agents

- Have any business company regulations that are prohibited by the authorities.

Incorporate International Companies and it can be suitably utilized for the following:

- International trading

- To act as a holding company and to hold investments either in UAE or foreign countries

- For holding properties in foreign countries and certain properties in UAE

Request for OurFree Consultation

Why Us?

Customised Solutions

Experienced Consultants

Hassle-Free Procedure